The State of Michigan has discovered it has a revenue surplus it wasn't planning on. Part of that money should go to increase funding for local governments and replace the funding that was stolen from them. Detroit's bankruptcy and emergency managers in more and more cities is shining the spotlight on a broken municipal funding model in Michigan.

This is not to excuse the failure of civic leaders in Detroit and elsewhere to clean up their own act. Lord knows that they sometimes have made horrible decisions for years. But when just about every city, township, and village in the state is having budget problems to a greater or lesser degree, than the problem is not only a failure of local leadership. Local units of government are in trouble, and it is not always their fault.

Between the Headlee amendment and Proposal A (which cap tax increases), both passed in the nineties, local governments have property tax revenues that fall further and further behind inflation each year. This has been going on for about 15 years so far. For cities (and counties and townships), property taxes are their source of tax revenues. They live and die with property tax collections.

Meanwhile, the State of Michigan also has the gas tax and income taxes. These are not capped or indexed to inflation. Having three different tax sources leads to a more stable revenue stream than just relying on property taxes.

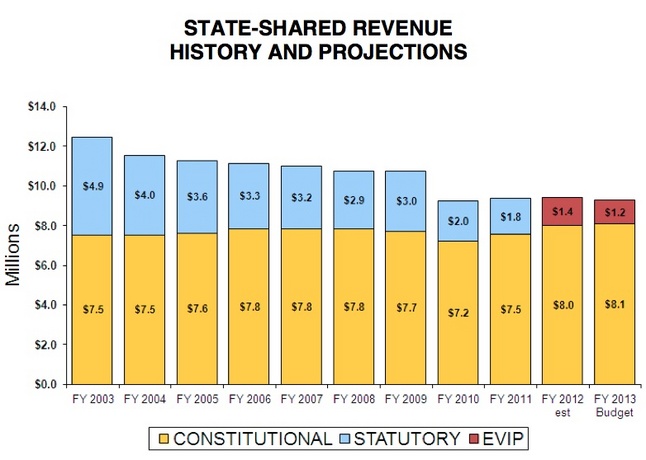

Michigan also is supposed to send the cities (and counties and townships) revenue sharing money, but can decide how much they want to pass along. Guess what? They have been cutting that when their own budget was tightened. Why cut your own spending when you can cut other people's spending, instead? The gap is getting bigger and bigger every year. As the chart below shows, revenue sharing has been declining and now includes less and less discretionary money. The constitutional money, Lansing has no choice. Otherwise they would cut that, too. What makes it more infuriating is when state lawmakers chastise local governments for not being fiscally responsible.

This system was a long-term disaster in the making, but things went downhill fast when property values plummeted and then recovered starting in 2008.

Although the State of Michigan did okay because their income and gas taxes rebounded when the economy did from the depths of 2008-09, local governments saw no such development. Instead, their property tax assessments dropped to the low values and, capped by Headlee, did not recover.

You can go to your local unit of government's web site and look for yourself. Unless the system changes, it won't be long before Gogebic County, Birmingham and Grosse Pointe Woods join Detroit in bankruptcy court.

No comments:

Post a Comment